Dubai Blues and Iraqi families Suffer in Syria

Posted by Joshua on Monday, November 30th, 2009

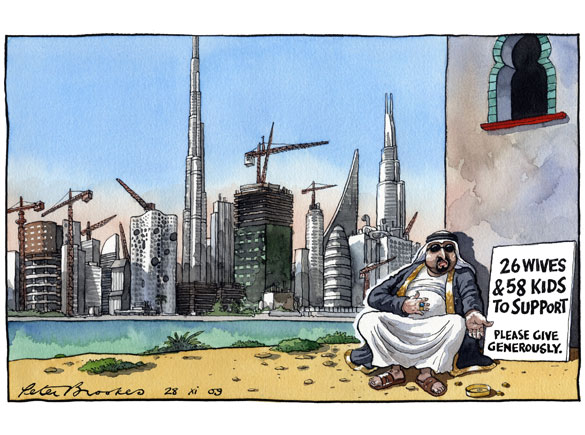

Reports are circling on Wall Street that Dubai’s debt may be as high as $120 billion (almost double initial estimates) and that Dubai’a ruler was “too proud” to admit the extent of the debt crisis. The Sunday Times has bad commentary on Dubai’s bust. This cartoon went along with the bad taste of the article.

SYRIA: Karrad, “If I stop working, how can we survive?”

Photo: Dana Hazeen/IRIN  |

| Karrad (right) and his brother Hussein hope to have a better future in a third country |

DAMASCUS, 30 November 2009 (IRIN) – Karrad, 16, and his family fled the sectarian violence in Iraq following the US-led invasion in 2003 and came to Syria in 2005. Although the Syrian government provides Iraqi children with free education in its public schools, Karrad and his brother Ali, 12, cannot go to school because they are the breadwinners. Karrad told his story to IRIN:

“I arrived with my parents and three brothers in Syria in 2005. As we were Shiites living in a Sunni neighbourhood [in Iraq], we used to receive many threats, which forced us to leave the country. My father used to work in the Iraqi security forces. In 2007, he went for a visit to Iraq and disappeared. We went back to look for him but we could not find out what happened to him.

“I was in grade six when we left Iraq in 2005 and have not been back to school since then. I did a number of jobs in Syria. [Initially] at a factory, then at a restaurant and grocery store among others. My brother Ali, 12, is working too.

“Then I started to have fights and arguments with my mother because she wanted our third brother, Hussein, to work too. I was against this. He was only 10 years old. Who will employ him and what can he do? It is enough that Ali and I are working. I wanted Hussein to remain in school.

Photo: Dana Hazeen/IRIN  |

| Karrad says he wants to work hard to be able to keep his youngest brother Hussein at school |

“After those things my mother decided to leave us. In March 2009 she took my youngest brother, Mohammed, 6, and left the house. She phoned us after two months to say that she had reached Greece. We haven’t heard from her since then.

“I live now with Ali and Hussein in this house. We don’t have any relatives here and nobody asks about us, including my relatives in Iraq. Ali and I work now in a real estate office while Hussein goes to school. I work from 9am to 9pm and earn SYP3,000 [about US$65] per month while Ali works from 9am to 7pm and earns SYP2,000 [about $43] per month. I have been in this job for about one-and-a-half years. Although the working hours are long I am happy because the people treat us well. We spend the day cleaning and making coffee and tea.

“We receive SYP8,500 [$184] from the UN Refugee Agency [UNHCR] every month but this amount goes for rent and electricity and water bills.

“I wish I could go back to school but if I stop working, how can we survive? I did not even think what I wanted to become in the future. All I think about is how to take care of my brothers.

“We struggled after our mother abandoned us because we are very much attached to our youngest brother Mohammed.

“All we hope for now is to be resettled in a third country because we don’t seem to have any future … neither in Syria nor in Iraq.”

Star-Ledger: Syrian rabbi’s supporters still shocked by money

2009-11-30

In the sweltering July rain, a white-bearded rabbi emerged from the federal courthouse in Newark and shuffled through a gantlet of news cameras. Saul J. Kassin, charged with money laundering in this summer’s epic federal sting, is the 88-year-old …

Discover more from Syria Comment

Subscribe to get the latest posts sent to your email.

Comments (5)

jo6pac said:

This sad what my country has done to others, I always wonder what happened to http://riverbendblog.blogspot.com/

jo6pac

Thanks Josh for your time

November 30th, 2009, 10:59 pm

Dania said:

That’s a horrible story, and I’ve even heard stories from Iraqi families which are even more depressing.

Education is free for Iraqis in Syria but lots of families can’t afford transportations, uniforms…etc, children are abused in these jobs. There are many INGOs providing help and support but with difficult conditions for some, UNHCR and WFO povide food only for families with no male head of household.

financial issue isn’t just the mere reason for Iraqi kids to drop out of schools, a lot of them face difficulties in Syrian Curriculum, language, faced some cases of discrimination, they lost documentation to register and many other reasons.

and many many Iraqis are waiting for resettlement in a third country which most of them won’t get, not any time soon any way, they stopped their children from going to schools waiting for the “call of heaven” jeopardising their children’s future.

It would be easy to blame the Syrian government which already suffers from weak infrastructure in many services, I am not trying to defend the Syrian government , I am not a big fan of it at all, but the international community must take responsibility for this disastrous situation they have created.

December 1st, 2009, 7:59 am

norman said:

This is for the Ehsanis of SC and others, it might be interesting to all,

Print this article

International calling

By Brian Caplen | Published: 28 October, 2009

Order reprint

Adib Mayaleh, governor of Central Bank of SyriaSyria’s banking sector has made great strides in the past two decades, but is still dominated by small regional banks. Now the country’s government is looking to major global names to take its economy forward. Writer Brian Caplen

Syria has been steadily liberalising its economy for the past two decades, with much of this effort focused on the banking sector. The time when six state-owned banks dominated the economy is long gone and private banks have become a central feature of the banking scene. Now the government is hoping to attract a major international bank to its shores and is proposing to raise foreign ownership limits and capital requirements to catapult the economy into a new era.

“Syria used to be a state-controlled, Soviet command style economy,” says Adib Mayaleh, governor of Central Bank of Syria (CBS) in an interview at the IMF/World Bank annual meetings in Istanbul last month. “Twenty years ago the Syrian economy started opening up. In the banking sector as little as five years ago there were only state banks. From 2005 we started with private banks, allowing foreign investors 49% stakes.”

Now the plan is to raise the limit to 60% and raise the minimum capital requirements for all banks to $200m, more than double existing amounts, with a three-year grace period for banks to comply.

Big is beautiful

At the moment the banks with foreign participation have mainly regional shareholders from Bahrain, Kuwait, Jordan and Lebanon. “We want to attract the major international banks with large capital,” says Mr Mayaleh.

“Under the existing rules we cannot develop the economy as we would like. Our banks are fairly small and we need big international banks with more capacity to build up and support the economy.”

Such a move would give a big push to private banking as, even after the reforms, state-owned banks still account for more than 80% of assets and 75% of deposits.

Mr Mayaleh is an advocate of gradual liberalisation, which, he says, has served Syria well as an alternative to the ‘big bang’ treatment that was tried and proved contentious in formerly state-run economies in eastern Europe. He notes of the IMF’s recent conversion to gradual reform: “It’s [the IMF’s] new idea! I’m glad they joined me.”

He agrees that reforming the banking sector in Syria has been easier than in other sectors where there are labour issues and huge restructuring needs to take place. Private banking was “new” to Syria (private banks had been abolished in 1963) and could be started afresh.

Interest and exchange rates have also been liberalised. In the 10th five-year plan (2005-10), two of the targets listed were “developing the monetary sector and guaranteeing the full independence of the CBS; developing the banking and financial sector as well as financial policies and launching the securities market”. The Damascus Stock Exchange began operating in March with banks dominating in the initial stocks traded.

A simple structure

Mr Mayaleh says that in 2005 there were four pages of instructions concerning interest rates, this has now been reduced to four lines. At one stage Syria had 17 exchange rates but now it has a single rate and taking money in and out of the country has become much easier.

In a policy document called ‘Four Years of Reform in Monetary Policy’, issued by the CBS and covering the period from 2005 to the second quarter of 2009, it says: “CBS has come a long way concerning monetary policy reform, especially in relation to the exchange system and exchange rate policy; it has [used] the political stability in Syria as solid ground for the reform process and as a cornerstone of the stability of both the monetary and the banking sector.”

One negative development for the economy was when the country became a net oil importer in 2006. Revenue from oil used to account for 17% of gross domestic product but this is now down to 4%, with output dropping from a peak of 590,000 barrels a day in 1996 to 385,000 today.

Agriculture is an important sector but as Mr Mayaleh says it is highly dependent on climatic conditions. Tourism, by contrast, he describes as “the new oil” with visitors increasingly attracted to Syria’s historic sites. “In Syria you can see the history of the world, we have great treasures,” he says.

According to a Dow Jones newswire report, Syria plans to raise money on the international and local markets for infrastructure and energy projects. In conjunction with the European Investment Bank, $2bn will be raised externally, says the report.

Order reprint

Related articles:

Mohammed Al-Hussein

Off to a flying start

© The Financial Times Limited – 2009.

December 1st, 2009, 1:19 pm

norman said:

December 1st, 2009, 3:22 pm

norman said:

The new Mideast starting to shape up,

Turkey and Jordan to abolish visa requirements reciprocally

Published: 12/1/2009

President Gül has left for Jordan to take up Middle East peace process and bilateral relations.

Accompanied by many Turkish businessmen, Turkish President Abdullah Gül left for Jordan on Tuesday.

Jordan’s King Abdullah will host the Turkish President.

The two leaders are due to give messages on regional problems regarding the Middle East peace process. Israel-Palestine conflict and its effects on the region will be taken up and President Gül will explain Turkey’s views on the Syria-Israel talks.

During the three-day visit, President Gül and King Abdullah will also sign free trade agreements on boosting bilateral trade volume. They are also expected to take up lifting visa requirements reciprocally. President Gül heralded non-visa application underscoring that a vast geography will become available for visa-free vacations in this way.

President Gül will also inaugurate $1,4 billion project undertaken by a Turkish firm in Jordan to remove water from underground.

December 1st, 2009, 4:30 pm

Post a comment